ETH Price Prediction: Can Ethereum Reach $5,000 Amid Bullish Momentum?

#ETH

- Technical Strength: ETH trades above key moving averages with converging MACD.

- Institutional Adoption: BitMine and ETF inflows reflect growing demand.

- Macro Catalysts: AI integration and stablecoin growth fuel long-term bullish thesis.

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

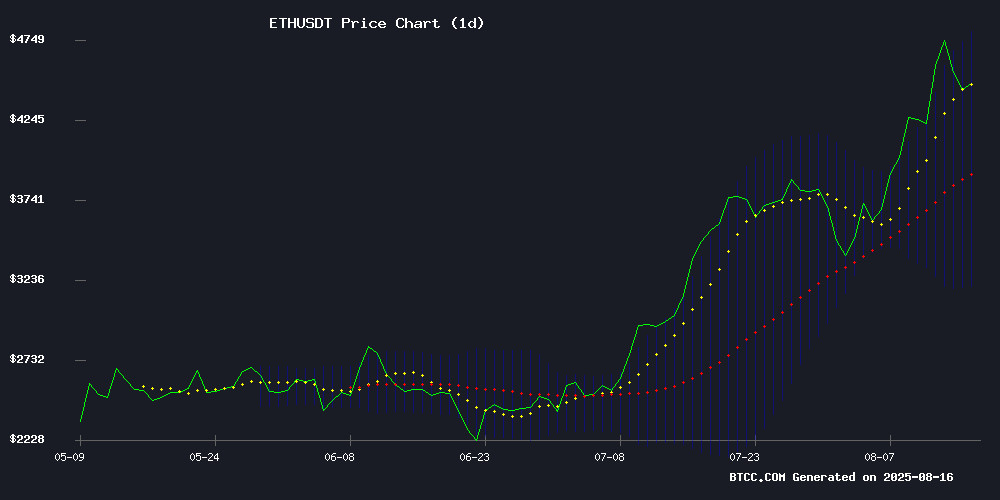

According to BTCC financial analyst James, ethereum (ETH) is currently trading at $4,458.90, showing strong bullish momentum above its 20-day moving average (MA) of $3,996.80. The MACD indicator remains negative but shows signs of convergence, suggesting potential upward momentum. Bollinger Bands indicate volatility, with the upper band at $4,799.67 and the lower band at $3,193.93. James notes that ETH's ability to hold above the middle band ($3,996.80) signals strength, with a potential test of $5,000 if bullish sentiment persists.

Ethereum Market Sentiment: Bullish Catalysts Ahead

BTCC financial analyst James highlights several bullish factors for Ethereum, including institutional interest from BitMine's $5B ETH holdings and Standard Chartered's raised price target to $25K. ETF inflows surged to $3B in August, while AI agents and stablecoin growth are seen as key drivers. However, concerns linger over the Ethereum Foundation's $30M sell-off and staking infrastructure strain. James believes these mixed signals are overshadowed by strong fundamentals, keeping the $5,000 target within reach.

Factors Influencing ETH’s Price

AI Agents Poised to Drive Ethereum's Next Growth Phase

Ethereum's transaction landscape may soon be reshaped by autonomous AI agents, according to Coinbase developers Kevin Leffew and Lincoln Murr. These self-executing programs could leverage a decades-old web standard—HTTP 402—alongside Ethereum's EIP-3009 to facilitate seamless stablecoin transfers without human intervention.

The integration enables AI systems to request services, receive automated payment prompts, and settle transactions instantly. This eliminates manual approvals, complex account setups, and delays in blockchain settlements—positioning Ethereum as an ideal network for machine-driven commerce. Potential applications range from self-driving vehicles paying for infrastructure to AI tools purchasing real-time data feeds.

Ethereum Price Analysis: What’s Next for ETH Amid Mixed Whale Activity?

Ethereum's price has retreated from recent highs, dropping over 3% to trade near $4.4k amid conflicting market signals. While institutional demand grows—evidenced by rising futures open interest and corporate treasury acquisitions—technical indicators flash caution as funding rates turn negative.

SharpLink Gaming's $3.3 billion ETH holdings and BitMine's $130 million purchase underscore growing corporate adoption. Yet the asset faces headwinds nearing overbought territory, creating tension between macro bullishness and short-term bearish technicals.

BitMine Surpasses 1M ETH Holdings, Valued at Over $5B

BitMine has emerged as the first corporate treasury to amass over 1 million Ethereum (ETH), with holdings reaching 1.17 million ETH by August 15. The stash, worth more than $5 billion, includes a recent addition of 317,126 tokens valued at approximately $2 billion in just one week. Chairman Tom Lee revealed ambitions to secure 5% of ETH's total supply, underscoring the firm's aggressive accumulation strategy.

The company's treasury initiative, launched on June 30, achieved this milestone in little over a month. BitMine now leads the sector, outpacing SharpLink Gaming's 728,804 ETH holdings. SharpLink has staked nearly all its ETH, generating 1,326 ETH in rewards, while raising $2.6 billion for further acquisitions.

Corporate treasuries are rapidly expanding their ETH exposure. Data shows 71 firms collectively hold 3.7 million ETH, representing 3.06% of the total supply. With an estimated $27 billion earmarked for additional purchases, corporate holdings could soon reach 10% of ETH's circulating supply.

BitMine's aggressive posture includes a $20 billion equity program expansion to fund acquisitions. The strategy has fueled a 1,100% stock surge, with daily trading volumes averaging $2.2 billion.

Standard Chartered Bank Raises Ethereum Price Targets to $25K on Stablecoin Growth

Ethereum's bullish momentum intensifies as institutional adoption, stablecoin expansion, and DeFi growth converge. Standard Chartered Bank now projects ETH to reach $7,500 by 2025 and $25,000 by 2028—a dramatic upward revision from previous targets of $4,000 and $7,500, respectively.

Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, cites deeper market participation and Ethereum's expanding role in global finance as key drivers. The network's dominance in staking and decentralized applications solidifies its position as a cornerstone of crypto infrastructure.

The recent passage of the Genius Act in the U.S. provides regulatory clarity for stablecoins, creating a foundation for explosive growth. Ethereum's integral role in the stablecoin ecosystem positions it to capture significant value as dollar-pegged tokens proliferate.

BitMine’s $130 Million ETH Purchase Strains Ethereum Staking Infrastructure

BitMine has solidified its position as the largest corporate holder of Ethereum with a $130 million purchase, bringing its total holdings to 1.15 million ETH. The transaction, routed through Galaxy Digital’s OTC desk and secured by BitGo, arrives as Ethereum’s staking queues reach multi-day highs, delaying validator activation timelines.

South Korean retail investors are pivoting from traditional tech stocks like Tesla to crypto-linked equities, underscoring shifting market sentiment. BitMine’s aggressive accumulation—funded partly by a $24.5 billion stock offering—highlights institutional confidence in ETH despite network congestion. The move pressures rivals to navigate both capital requirements and logistical hurdles in a tightening staking landscape.

Ethereum Eyes $7,000 by Year-End Amid Bullish Outlook

Ethereum (ETH) is poised for a significant rally, with Standard Chartered revising its year-end price target to $7,000—a substantial increase from the previous $4,000 projection. The cryptocurrency has surged nearly 29% in the past week, trading just 4% below its all-time high of $4,878. Analysts view this consolidation as a bullish signal, with a potential breakout paving the way for new price discovery.

Institutional demand is fueling the optimism. Ethereum spot ETFs have attracted record inflows, including a single-day influx of $1 billion. Year-to-date, these products have drawn $8.2 billion, underscoring growing confidence among institutional investors. The market structure appears robust, with tight consolidation indicating strong buying interest.

SharpLink Gaming Plummets on Q2 Loss Amid Ethereum Market Cooling

SharpLink Gaming's stock tumbled nearly 15% Friday after reporting a $103 million net loss for Q2, a dramatic reversal from its $12 million profit during the same period last year. Revenue fell 30% year-over-year to $1.4 million, with gross profit halving to $0.3 million. The losses stem partly from an $87.8 million impairment charge on LSE holdings—a tokenized staked Ethereum product.

Meanwhile, Ethereum retreated below $4,400 amid geopolitical tensions and strong U.S. economic data, cooling its recent rally. The dip follows SharpLink's May announcement pivoting to an Ethereum-centric corporate strategy, marking its first earnings report since the strategic shift.

Gemini Launches Self-Custody Wallet with Onchain Dashboard

Gemini, the cryptocurrency exchange founded by the Winklevoss twins, has introduced a new self-custody wallet product. The Gemini Wallet aims to compete with established players like Coinbase and Kraken in the consumer market. The wallet integrates with a web-based dashboard called "Onchain," providing users with a comprehensive view of their crypto portfolios and trading capabilities.

The onboarding process is notably streamlined, leveraging device passkey technology for instant wallet generation. Users receive a free .gemini.eth ENS name, adding a layer of convenience. Unlike traditional exchange accounts, the wallet requires no KYC or personal information, emphasizing privacy and ease of use.

Currently, the wallet is accessible via web browser, with potential mobile and Chrome extension versions in development. The lack of visible seed phrases and password-free setup marks a departure from conventional wallet designs, signaling Gemini's focus on user-friendly innovation.

Estonian Banker’s Lost Ethereum Wallet Surges to $1.2 Billion Amid Crypto Boom

Rain Lõhmus, an Estonian banker, has become an inadvertent symbol of both crypto’s meteoric rise and its unforgiving nature. His Ethereum wallet, purchased in 2014 and long since inaccessible, now holds an estimated $1.2 billion as ETH briefly touched $4,700 in August 2025. What began as a modest investment has ballooned into a fortune—one that remains tantalizingly out of reach.

The wallet’s value was roughly $400 million in 2023 when Ethereum traded near $1,600. Its growth mirrors ETH’s decade-long ascent from niche experiment to cornerstone of decentralized finance. On-chain data from Arkham Intelligence confirms the stash remains untouched, with only minor "dust" transactions recorded.

Coinbase product director Conor Grogan publicly linked the wallet to Lõhmus, who has openly lamented the loss. The episode underscores crypto’s double-edged sword: self-custody eliminates intermediaries but demands flawless key management. "It’s like losing a password," Lõhmus remarked, downplaying a mistake worth nine figures.

Ethereum Nears $4,800 as ETF Inflows Surge to $3 Billion in August

Ethereum's price trajectory is accelerating toward a potential breakout at $4,800, fueled by record inflows into spot ETH ETFs. Institutional investors have poured over $3 billion into these regulated products in the first half of August alone, with daily inflows peaking above $1 billion. This capital influx marks a pivotal shift in market sentiment toward Ethereum.

The cryptocurrency has rallied nearly 20% this week, testing three-year highs at $4,765. Traders now watch whether ETH can overcome the critical $4,891 all-time high set in November 2021. Liquidity surges from ETF adoption are creating sustained buying pressure, though some anticipate profit-taking near historic resistance levels.

Ethereum Foundation's $30M ETH Sell-Off Sparks Price Decline Concerns

Ethereum's price has retreated 5.5% to $4,600 following a series of high-profile transactions from wallets linked to the Ethereum Foundation. The organization moved 4,095 ETH ($18.7M) across three transactions at prices between $4,518-$4,602, adding to earlier sales totaling $31.5 million.

On-chain analysts highlight growing bearish signals: exchange inflows are rising while over $3 billion in ETH awaits unstaking. Foundation transactions often precede local market tops, with these sales coinciding with ETH's approach toward all-time highs.

The market reaction reflects deeper concerns about institutional positioning. Large-scale movements from foundation-controlled wallets historically correlate with cooling periods, though some traders view this as healthy profit-taking after ETH's 2024 rally.

Will ETH Price Hit 5000?

BTCC analyst James projects a high likelihood of ETH testing $5,000, supported by technical and fundamental factors:

| Factor | Impact |

|---|---|

| Technical Breakout | Price above 20-day MA and approaching upper Bollinger Band |

| Institutional Demand | BitMine's $5B holdings and $3B ETF inflows |

| Macro Sentiment | Standard Chartered's $25K long-term target |

Key resistance lies at $4,800 (upper Bollinger Band), but sustained buying pressure could propel ETH to $5,000 by Q4 2025.